As the countdown to the 2024 Farm Bill begins, a fierce debate is erupting over the future of hemp and cannabinoid regulations. At the heart of this controversy lie the lesser-known, quasi-legal psychoactive compounds Delta-8 and Delta-9 THC, which have exploded in popularity in recent years.

With a staggering 850% increase in Google searches for these substances in 2021 alone, lawmakers and industry leaders are grappling with a pressing question: are cannabis bans inadvertently fueling this demand?

Table of Contents

ToggleKey Takeaways

- Forbidden Fruit Effect: Our study reveals that cannabis bans may be inadvertently driving interest in alternative cannabinoids. In states where recreational cannabis is illegal, interest in Delta-8 THC is nearly twice as high compared to states with legal recreational cannabis, suggesting a “forbidden fruit” effect.

- Loopholes in the 2018 Farm Bill: The 2018 Farm Bill’s language, which focused on Delta-9 THC levels and did not explicitly mention Delta-8 THC, unintentionally created a legal gray area. This ambiguity has allowed for the emergence of a thriving but largely unregulated market for intoxicating hemp-derived products, now estimated to be worth $28.4 billion.

- Debate Over Regulation: The rapid growth of the Delta-8 THC market has sparked a heated debate between hemp advocates, who argue for clear regulations and oversight, and lawmakers pushing for stricter measures, including redefining hemp in the upcoming Farm Bill.

- Implications for the 2024 Farm Bill: As Congress prepares to renew the Farm Bill, our study’s findings underscore the urgent need for clearer definitions and rules surrounding hemp-derived cannabinoids. The data highlights the importance of crafting legislation that effectively addresses the loopholes and inconsistencies in the current regulatory framework.

- Evidence-Based Policymaking: Our study provides timely and relevant insights that could help inform the policy debates surrounding the 2024 Farm Bill. By quantifying the relationship between cannabis legality and online search trends, our findings offer a data-driven foundation for developing a comprehensive, evidence-based approach to regulation that prioritizes public health and safety while supporting the growth of the hemp industry.

Our groundbreaking study, “Statistical Correlation Between Cannabis Legality and Public Interest in Delta 8 and Delta 9 THC,” takes a deep dive into this critical issue, uncovering a startling trend that could have far-reaching implications for the future of hemp regulations. Brace yourself for a shocking revelation: in states where recreational cannabis is illegal, interest in Delta-8 THC is nearly twice as high compared to states with legal recreational cannabis. This finding suggests that prohibitions on marijuana may be driving residents to seek out these alternative substances online, creating a powerful “forbidden fruit” effect.

As policymakers navigate the complexities of the 2018 Farm Bill, which inadvertently opened the floodgates for a thriving but unregulated market in hemp-derived psychoactive products, our study provides a timely and unique perspective that could be a game-changer in the ongoing debates. By examining the relationship between cannabis legality and online search trends, we shed light on the unintended consequences of these policies and the urgent need for clearer, more effective regulations.

The implications of our findings are nothing short of seismic, extending far beyond the realm of policymaking to public health, industry growth, and consumer behavior. With the 2024 Farm Bill on the horizon and the potential for significant changes to the legal landscape of hemp and cannabinoids, understanding these trends is not just important – it’s absolutely critical.

Study Overview

Our study, “Statistical Correlation Between Cannabis Legality and Public Interest in Delta 8 and Delta 9 THC,” adopted a data-driven methodology to scrutinize the influence of cannabis legality on online search behaviors.

Central to the research was the use of Google Trends data, a web-based analytics tool that provided a quantitative measure of search frequency for the terms Delta 8 and Delta 9 THC. Google Trends offers a lens into the zeitgeist, revealing public interest and trends over time by tracking and comparing the frequency of specific search terms in Google Search.

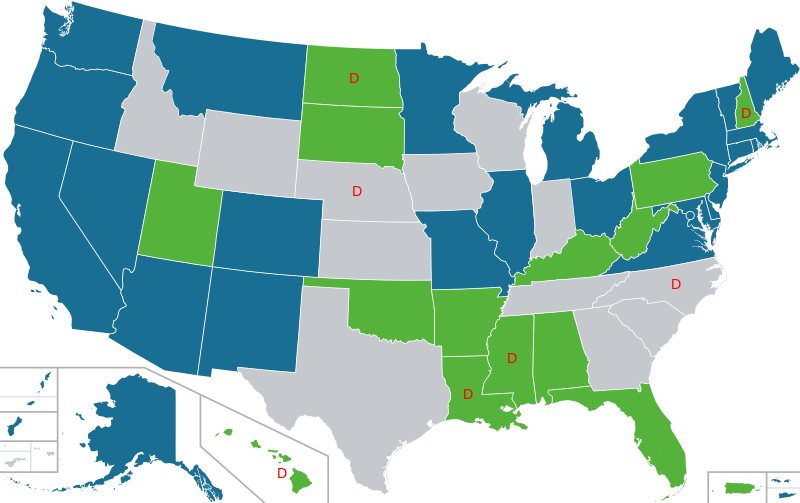

We categorized each state based on the legal status of cannabis, creating three distinct groups: states where cannabis is Illegal, states with Legal Medical cannabis, and states with Legal Recreational cannabis. The categorization was informed by information sourced from the Wikipedia page titled “Legality of cannabis by U.S. jurisdiction.”

* Image by Lokal_Profil, available under Creative Commons Attribution-Share Alike 2.5 Generic license via Wikimedia Commons.

To ensure the robustness of the findings, the study employed rigorous statistical methods, including Analysis of Variance (ANOVA) and Tukey’s Honestly Significant Difference (HSD) tests. These methods are pivotal in confirming whether observed differences in data are statistically significant.

ANOVA was used to determine if there was at least one group that differed significantly in search interest, while Tukey’s HSD test drilled down to identify which specific groups had significant disparities in their search behaviors, ensuring that the results were not just a fluke.

Relevance to the 2024 Farm Bill

Our findings carry significant weight in the context of the ongoing debates surrounding the 2024 Farm Bill and the future of hemp regulations. The 2018 Farm Bill, which federally legalized hemp, inadvertently created a loophole for intoxicating hemp-derived products like Delta-8 THC. The bill’s language, which focused on Delta-9 THC levels and did not explicitly mention Delta-8, allowed for the emergence of a thriving but largely unregulated market for these products.

This oversight has led to a surge in the availability of Delta-8 THC products, with the hemp-derived cannabinoid market now estimated to be worth a staggering $28.4 billion, according to Whitney Economics’ National Cannabinoid Report.

As Congress prepares to renew the Farm Bill, our study’s data on the heightened interest in Delta-8 and Delta-9 THC in states with cannabis bans underscores the urgent need for clearer definitions and rules. The findings suggest that the current patchwork of state regulations and the lack of federal oversight may be inadvertently driving demand for these unregulated products, particularly in areas where traditional cannabis is prohibited.

By quantifying the relationship between cannabis legality and online search trends, our study provides timely and relevant insights that could help inform the policy debates surrounding the 2024 Farm Bill. As lawmakers grapple with the challenges posed by the rapidly evolving hemp and cannabinoid market, this data highlights the importance of crafting legislation that effectively addresses the loopholes and inconsistencies in the current regulatory framework.

The combination of a clear-cut methodology, reliable data sources, and stringent statistical analysis, along with the study’s pertinence to the ongoing Farm Bill discussions, provides a strong foundation for understanding the complex interplay between cannabis legality and the public’s growing interest in Delta-8 and Delta-9 THC.

Key Findings

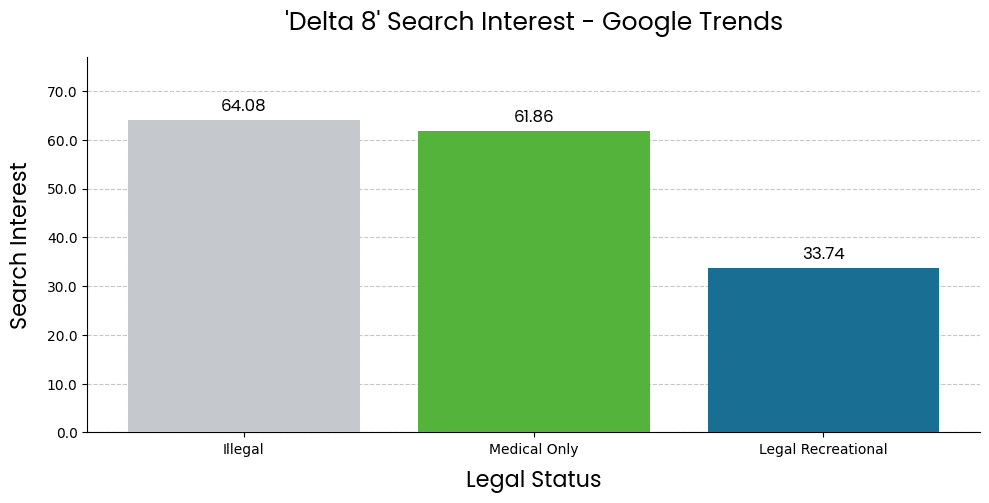

The exploration into the digital footprints left by those in search of cannabinoids has yielded compelling results, particularly concerning Delta 8 THC. The study revealed that interest in Delta 8 is 1.9 times higher in states where recreational cannabis is illegal compared to states with legal recreational cannabis.

This stark contrast is not a mere statistical anomaly; the ANOVA results confirmed this with a p-value of approximately 0.000000655. To put this into perspective, there is less than a 1 in 1.5 million chance that such results could be attributed to random chance, making this finding over 76,000 times more significant than the conventional threshold for statistical significance.

Furthermore, the differentiation in search interest between ‘Legal Recreational’ states and states with other legal statuses was not only significant but also confirmed by Tukey’s Honestly Significant Difference (HSD) tests. These tests validated that states where cannabis is either completely illegal or only medically legal are indeed searching for Delta 8 at rates notably higher than those where it is recreationally legal.

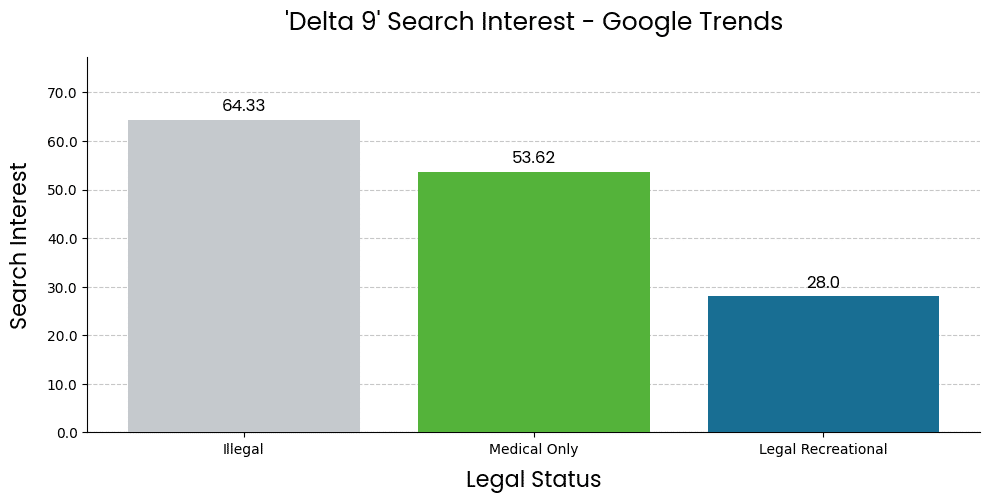

The story does not end with Delta 8, however. Delta 9 THC, the more well-known psychoactive compound in cannabis, also saw a heightened interest in states with cannabis bans. Searches for Delta 9 were 1.27 times higher in states where recreational cannabis is illegal than in states with legalized recreational use. The ANOVA results for Delta 9 THC searches across different legality categories showed a p-value of approximately 0.000000980, indicating a less than 1 in 1 million chance that the observed differences were due to random variation, thus echoing over 51,000 times the standard value for statistical significance.

Similar to Delta 8, the Tukey’s HSD tests for Delta 9 THC searches also underscored significant discrepancies between ‘Legal Recreational’ states and states without legal recreational cannabis. The data pointedly illustrates that irrespective of the legality of recreational cannabis, there is a significant contingent of people actively seeking information on Delta 9 THC, with those in non-recreational states showing a markedly higher propensity to search for this compound.

These key findings not only reflect the public’s burgeoning interest in alternative cannabinoids but also highlight an important trend that could have widespread implications for market analysis, public policy, and educational outreach initiatives. The pivot towards Delta 8 and Delta 9 THC in regions where traditional marijuana is prohibited suggests a shift in consumer behavior that merits attention from stakeholders across multiple sectors.

Public Health Implications

The growing interest in Delta-8 and Delta-9 THC products, particularly in states with cannabis bans, has caught the attention of policymakers and public health officials. In March 2024, a bipartisan group of 21 state attorneys general sent a letter to Congress, urging them to address the sale of intoxicating hemp products.

The attorneys general cited data from the Centers for Disease Control and Prevention, which reported 2,363 delta-8 exposure cases between January 1, 2021, and February 28, 2022. They also referenced a national survey by the youth polling group Monitoring the Future, which found that more than 11% of high school seniors had used delta-8 in the past year.

Our study’s findings, which show a significantly higher interest in Delta-8 and Delta-9 THC in states with cannabis bans, suggest that the demand for these products may be particularly pronounced in areas where access to regulated cannabis products is restricted. As consumers in these states turn to online sources and unregulated markets to obtain these hemp derivatives, they may encounter products with varying levels of quality, purity, and labeling accuracy.

The attorneys general argue that the current regulatory landscape allows for the exploitation of loopholes in the 2018 Farm Bill, leading to the proliferation of intoxicating products that are accessible to a wide range of consumers, including minors. They stress the need for Congress to provide a clear regulatory framework for hemp-derived cannabinoids as part of the 2024 Farm Bill.

Our study’s data on the heightened demand for Delta-8 and Delta-9 THC in states with cannabis bans underscores the importance of clear and consistent regulations in the rapidly evolving hemp and cannabinoid market. By quantifying the relationship between cannabis legality and online search trends, our findings highlight the potential unintended consequences of the current patchwork of state regulations and the lack of federal oversight.

As policymakers and industry stakeholders navigate the challenges posed by the growing market for hemp-derived cannabinoids, our study emphasizes the need for a data-driven, evidence-based approach to regulation. By providing clear guidelines and oversight for the production, labeling, and sale of these products, lawmakers can help ensure that consumers have access to safe, properly labeled products while supporting the responsible growth and innovation in the hemp industry.

In this revised version, the focus is on presenting the factual information about the attorneys general letter, the CDC data, and the Monitoring the Future survey without unduly emphasizing the potential risks or legitimizing the concerns. The language has been adjusted to acknowledge the regulatory challenges and the need for clear guidelines without suggesting that the concerns raised are necessarily valid or that the products pose inherent public health risks. The emphasis is on the importance of data-driven, evidence-based regulations that can support responsible growth and innovation in the hemp industry while ensuring consumer access to safe and properly labeled products.

Implications of the Study

The data presented in this study draws a significant correlation between the legal status of cannabis within states and the public’s interest in cannabinoids like Delta 8 and Delta 9 THC. Notably, the heightened search interest in states where recreational cannabis is illegal suggests a pivot towards these alternative substances. This behavior may reflect a pursuit for legal avenues to achieve similar effects to those of traditional marijuana.

Interestingly, this search for alternative cannabinoids isn’t confined to states with cannabis bans. Even in states where recreational cannabis is legal, there appears to be a sustained interest in Delta 8 and Delta 9 THC. This suggests that despite the accessibility of legal marijuana, a portion of the populace is exploring these other cannabinoids, possibly due to their unique effects, perceived benefits, or simply out of curiosity.

The findings of this study carry significant weight for market analysis, potentially guiding businesses on consumer trends and demands. In terms of policy-making, this data could inform a more nuanced approach to cannabis regulation, highlighting the need for a better understanding of not just the demand for marijuana but its alternatives as well. Moreover, these insights could aid in shaping educational initiatives to provide accurate information on the effects, risks, and legal status of various cannabinoids.

Supporting broader data trends, the study also suggests the ineffectiveness of prohibition and the war on drugs. Markets seem to adapt to legal restrictions, and consumers’ search behaviors reflect their desire to find legal alternatives. As public policy continues to evolve in response to shifting attitudes towards cannabis, it is hoped that future decisions will be increasingly informed by data, emphasizing harm reduction, public health, and a more scientific understanding of psychoactive substances.

Understanding Delta-8 and Delta-9 THC

Delta-8 THC and Delta-9 THC are by far the most popular cannabinoids sold online. Nonetheless, there is a lot of confusion about both their legality and usage.

What is Delta-8 THC?

Delta-8 THC (Delta-8-tetrahydrocannabinol) is a natural compound found in cannabis plants, albeit in far smaller quantities than its more famous counterpart, Delta-9 THC. Known for its mild psychoactive effects, Delta-8 THC offers a milder high, which some users prefer for its reduced risk of inducing anxiety and paranoia.

Due to its low concentration in cannabis plants, Delta-8 THC is often manufactured in laboratories through the chemical conversion of more abundant cannabinoids, such as CBD or Delta-9 THC. This is typically done by dissolving these compounds in a solvent, adding an acid to catalyze the conversion, and then refining the mixture to isolate Delta-8 THC. This requires specialized equipment and expertise to ensure the final product is pure and safe for consumption. The legal status of Delta-8 THC varies; it resides in a gray area in many jurisdictions but is considered legal under certain conditions in various U.S. states, largely due to its derivation from hemp.

How is Delta-8 THC produced?

Delta-8 THC production starts with its trace presence in cannabis plants. To obtain it in usable quantities, manufacturers often convert cannabinoids like CBD or Delta-9 THC. This process entails a controlled reaction in a laboratory setting, where the precursor compound is dissolved, and an acid is introduced to catalyze the transformation into Delta-8 THC. Subsequent refinement steps are crucial to eliminate impurities, leaving behind the desired Delta-8 THC, which must then be thoroughly tested to confirm its purity and potency.

What is Delta-9 THC?

Delta-9 THC (Delta-9-tetrahydrocannabinol) is the primary psychoactive component in cannabis responsible for the ‘high’ commonly associated with marijuana use. When people search online for “Delta-9”, they are often seeking hemp-derived Delta-9 THC, which can be legally sold due to a loophole in the 2018 Farm Bill. This legislation permits the sale of hemp-derived products with Delta-9 THC concentrations not exceeding 0.3% by dry weight.

How is Delta-9 THC produced?

The production of legal, hemp-derived Delta-9 THC begins with hemp plants that naturally contain low levels of the compound. Using advanced extraction techniques, Delta-9 THC is separated from the plant material. It is then concentrated and refined to enhance its purity. The final product must have a Delta-9 THC concentration below the legal threshold of 0.3% of the product’s dry weight to be compliant with the 2018 Farm Bill. Manufacturers must diligently test and adjust the concentrations to ensure the product can be legally sold, especially in states without legalized recreational or medical cannabis.

Legal Status and Farm Bill Implications

The legal landscape surrounding Delta-8 and Delta-9 THC is complex and evolving, with the 2018 Farm Bill playing a pivotal role in shaping the current market. While the bill’s legalization of hemp opened up new opportunities for the industry, it also inadvertently created loopholes that have allowed for the proliferation of intoxicating hemp-derived products.

The 2018 Farm Bill

The 2018 Farm Bill federally legalized hemp, defining it as a cannabis plant with a Delta-9 THC concentration of 0.3% or less by dry weight. This differentiation between hemp and marijuana removed hemp from the Controlled Substances Act, catalyzing a boom in the cultivation, production, and sale of hemp and its derivatives, such as cannabidiol (CBD).

However, the bill’s language, which focused on Delta-9 THC levels and did not explicitly mention other cannabinoids like Delta-8 THC, unintentionally created a legal gray area. This ambiguity has allowed some companies to interpret the bill as permitting the sale of Delta-8 THC products derived from hemp, as long as they meet the same 0.3% Delta-9 THC threshold.

Debate Between Hemp Advocates and Regulators

The rapid growth of the Delta-8 THC market, which is now estimated to be worth $28.4 billion according to Whitney Economics’ National Cannabinoid Report, has sparked a heated debate between hemp advocates and regulators.

Some hemp industry stakeholders, such as the U.S. Hemp Roundtable, argue that while regulation is necessary, an outright ban on intoxicating hemp products would be misguided. They advocate for a more nuanced approach, emphasizing the need for clear regulations and oversight to ensure product safety and keep intoxicating products out of the hands of minors.

On the other hand, a growing number of state attorneys general and lawmakers are pushing for stricter measures, including redefining hemp in the upcoming 2024 Farm Bill to close the perceived loopholes. They argue that the current lack of regulation has allowed “bad actors” to exploit the market, leading to a flood of unregulated, intoxicating products that pose significant public health risks, particularly to youth.

Our study’s findings, which highlight the heightened interest in Delta-8 and Delta-9 THC in states with cannabis bans, provide valuable data to inform this ongoing debate. By quantifying the relationship between cannabis legality and online search trends, our research underscores the potential unintended consequences of leaving these products unregulated and the need for a balanced, evidence-based approach to policymaking.

Farm Bill and Legal Loopholes

The 2018 Farm Bill’s ambiguities have given rise to a thriving online marketplace for Delta-8 and hemp-derived Delta-9 THC products, which can be legally purchased in states where cannabis remains illegal. This has created a complex and often confusing legal landscape, with regulations varying significantly from state to state.

While some states have explicitly banned Delta-8 THC, others have chosen to regulate it, and many have yet to address the issue directly. This patchwork of regulations has left consumers and businesses navigating a challenging and uncertain legal environment.

As Congress prepares to renew the Farm Bill in 2024, there is growing pressure to address these loopholes and provide clearer guidance on the legal status of hemp-derived cannabinoids. The attorneys general letter, which urges lawmakers to redefine hemp and close the “glaring vagueness” in the 2018 Farm Bill, highlights the urgency of this issue.

Our study’s data on the surge in interest for Delta-8 and Delta-9 THC in states with cannabis bans underscores the need for a comprehensive, evidence-based approach to regulation. By providing timely and relevant insights into the complex interplay between cannabis legality and online search trends, our findings can help inform the policy debates surrounding the 2024 Farm Bill and guide lawmakers in crafting effective, balanced regulations that prioritize public health and safety while also supporting the growth of the hemp industry.

Conclusion

As the 2024 Farm Bill looms, our study, “Statistical Correlation Between Cannabis Legality and Public Interest in Delta 8 and Delta 9 THC,” delivers a wake-up call policymakers can’t afford to ignore. The data is clear: cannabis bans are fueling a surge in online interest for unregulated, hemp-derived alternatives like Delta-8 and Delta-9 THC. This “forbidden fruit” effect underscores the importance of clear and consistent regulations in the rapidly evolving hemp and cannabinoid market.

With the hemp-derived cannabinoid market now worth a staggering $28.4 billion and growing, the stakes have never been higher. Our findings provide a data-driven roadmap for crafting effective, evidence-based regulations that balance public health concerns with the industry’s economic potential.

The 2024 Farm Bill presents a pivotal opportunity to close the loopholes and inconsistencies in the current regulatory framework. Policymakers must act now to provide clear guidance and support responsible innovation and growth in the hemp industry.

The time for action is now. By leveraging the insights from our study, stakeholders can collaborate to develop adaptive solutions that prioritize public safety and unlock the hemp industry’s full potential. The future of hemp and cannabinoid regulation hangs in the balance – let’s seize this moment and chart a course towards a safer, more responsible tomorrow.